CMS recently released updated information on the value-based purchasing program. The data included a facility-level look at how the program is going. CMS also expressed concern during the Open Door forum that the rate of re-hospitalization had increased over the baseline year even with the financial incentive.

Let’s take a closer look at the data, shall we?

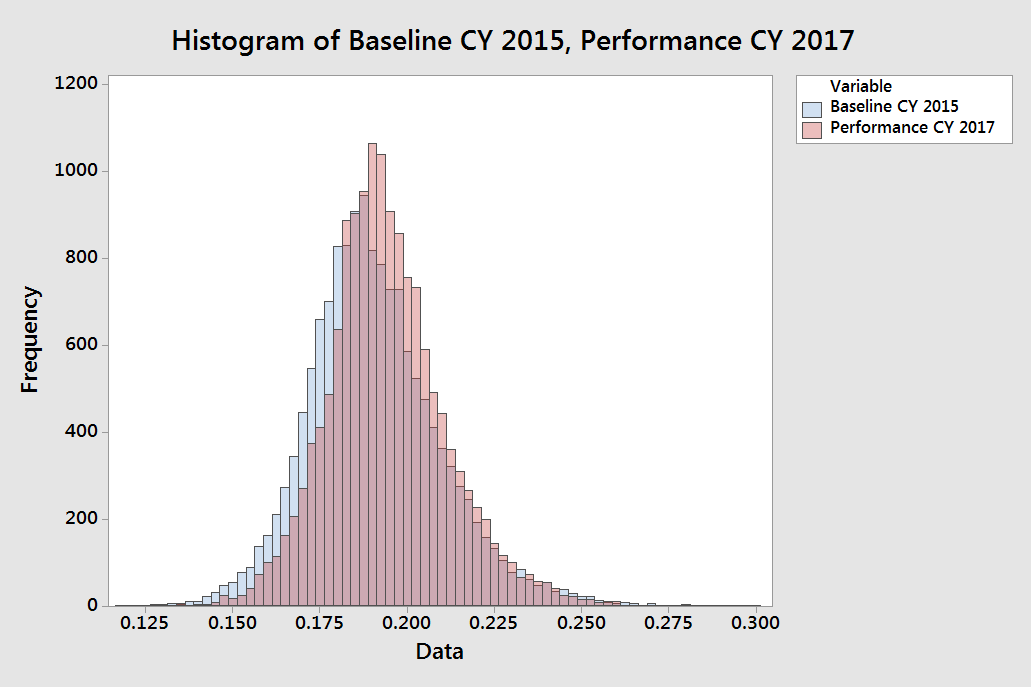

Using a simple histogram we can see that the rate of re-hospitalization did increase over the 2015 baseline. (See below. Pink is 2017. Blue is 2015.) The mean value went from 19.057% to 19.414%. Perhaps as interesting is the standard deviation dropped from 1.9% to 1.7%. You can easily see this in the histogram by the height of the red peak versus the blue peak. Takeaway: The rate of re-hospitalization increased slightly and was more consistent in 2017 versus 2015.

Click to enlarge

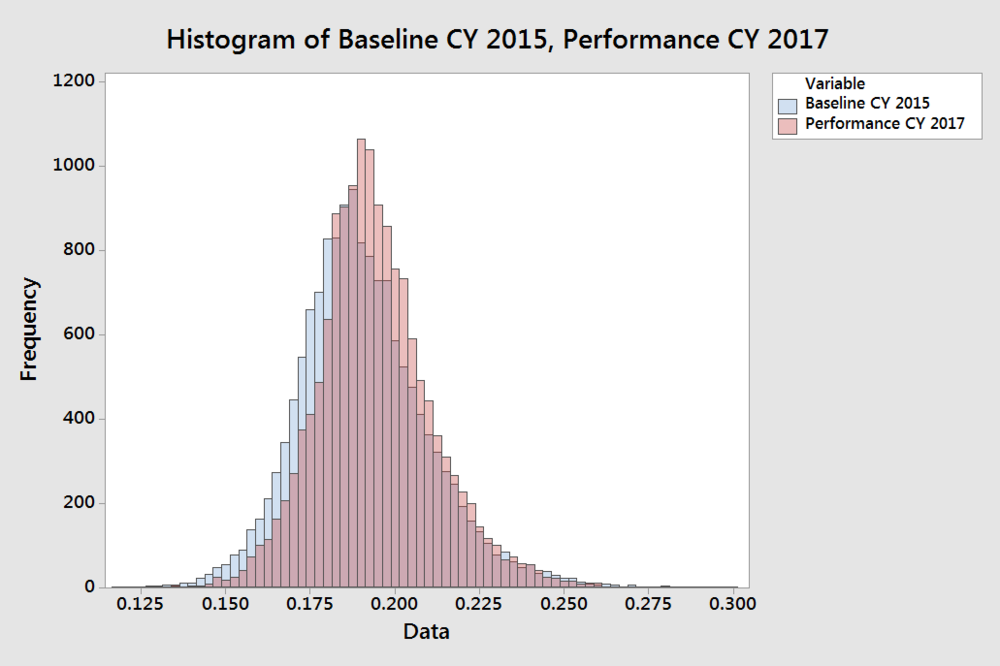

If you look at the individual differences you can see a surprisingly tight distribution centered just higher than zero. I am really impressed by just how consistent these numbers look. Takeaway: The individual differences in re-hospitalization are fairly consistent across the country.

Why?

So we’ve established that there were slightly more re-hospitalizations in 2017 versus 2015 and that the data doesn’t appear to be driven by outliers. Is there any indication why?

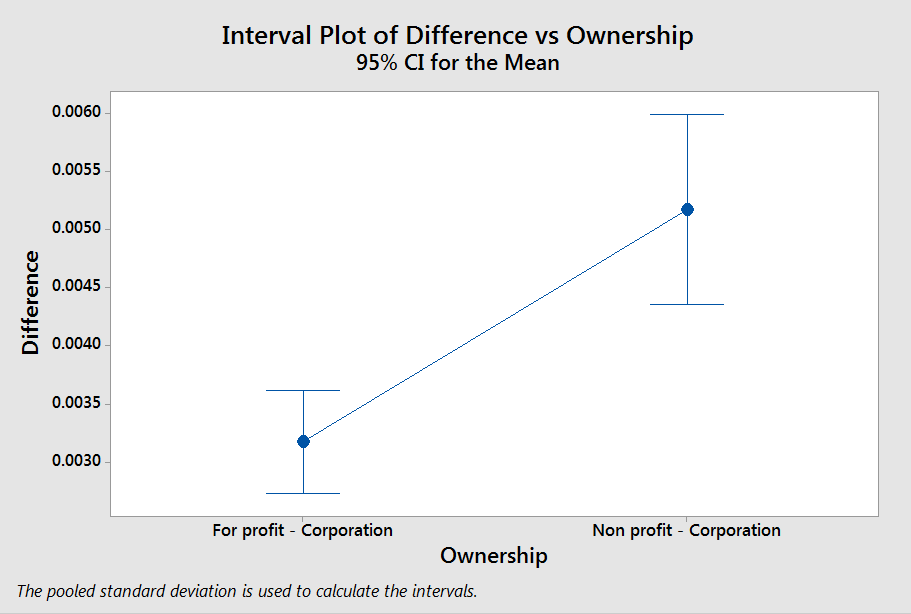

Ownership?

In the past we’ve seen cases where Non-Profits might outperform their For-Profit peers. Let’s take a look at that.

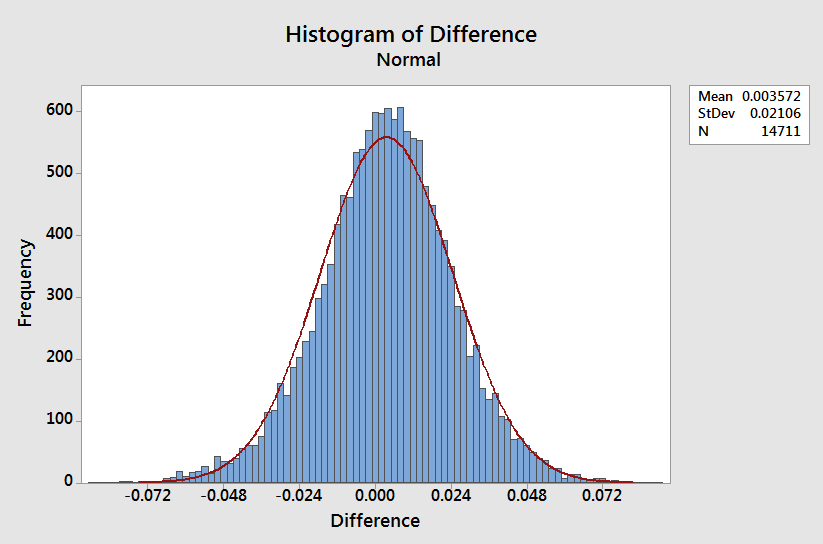

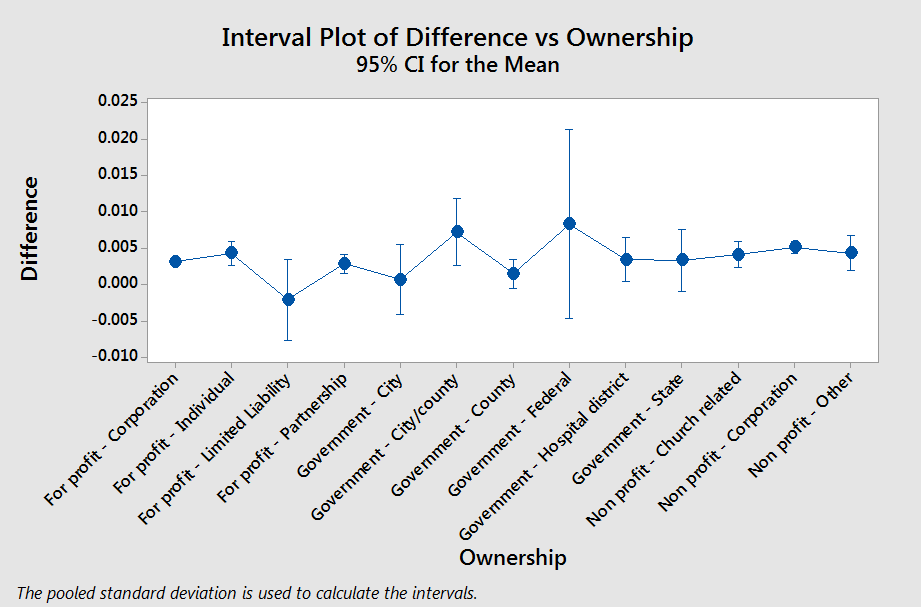

Based on ANOVA analysis, we can see there are really only a couple of small differences. I’ll zoom in on the big one:

Based on this we can see that Non-Profit Corporations increased re-hospitalizations more than other provider types and this difference is statistically significant. This data tells me nothing about why that might the case and I won’t speculate here. Takeaway: Non-Profit Corporations showed slightly higher increases in re-hospitalization compared to everyone else, including other types of non-profits.

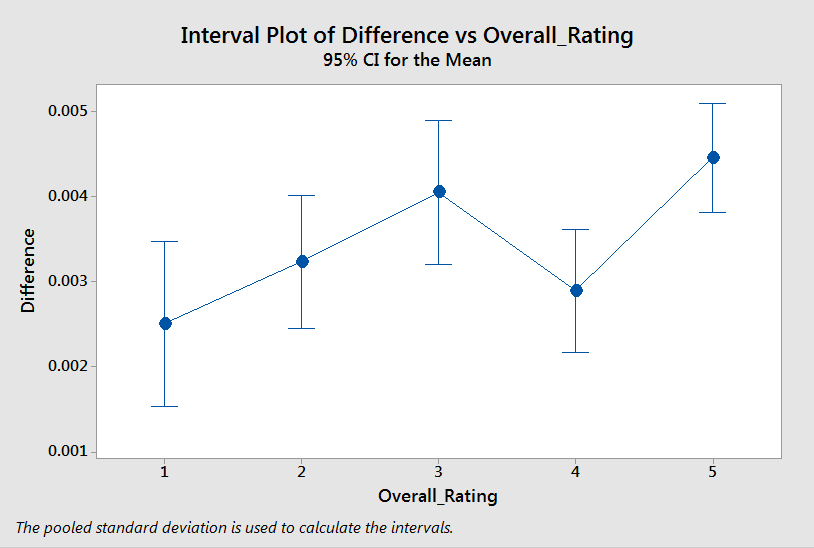

Star Ratings?

Do homes with higher star ratings show lower increases in re-hospitalization? That would be incredibly satisfying, right?

Well, if anything, 5 star homes showed slightly higher rates of increase of re-hospitalization. I tend to dismiss this one as an an anomaly. You’re probably thinking overall star rating is the wrong one to choose. We should be looking at staffing star ratings.

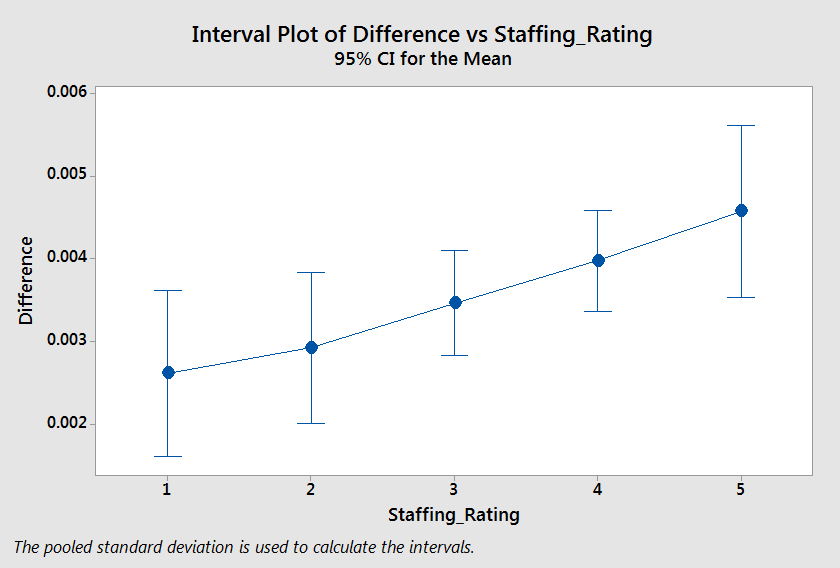

Now it’s easy to look at this one and see a trend. Trust me, there’s nothing here. All of those intervals overlap. Higher staffing stars does not correlate with higher rates of increase in re-hospitalization.

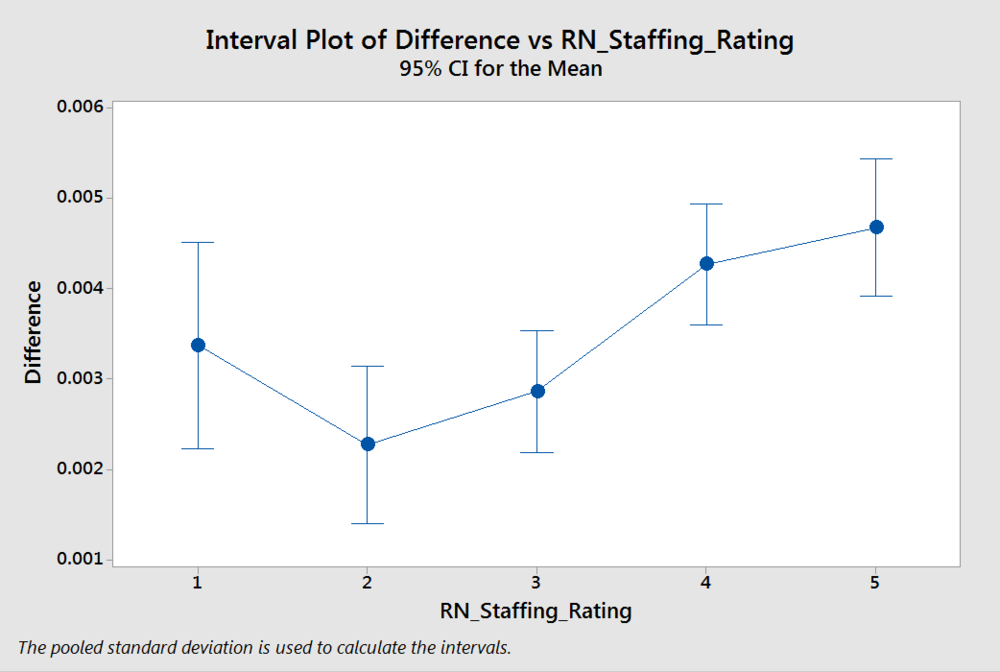

To put this one to rest we’ll look at RN Staffing Ratings too.

Okay, while I’m still not completely sold on the relationship, this one does indicate that 2 and 3 star RN staffing homes had lower rates of increase in re-hospitalization. I wouldn’t draw too many conclusions from this since the relationship is pretty weak. Perhaps having fewer RNs around reduces the chances of recognizing when someone needs to go to the hospital? Takeway: Star ratings do not clearly correlate to re-hospitalization.

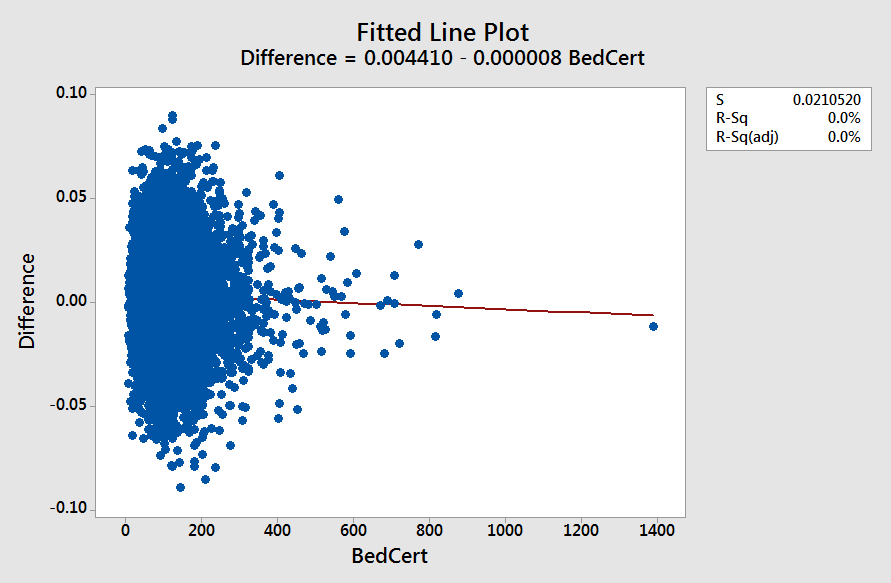

Number of Beds

Do larger SNFs do a better job creating and implementing programs to reduce re-hospitalization?

In a word? No.

This does bring up an interesting point though. The CMS data treats all SNFs the same. That is, a 200 bed home is weighted the same as a 10 bed home. What would the averages look like if they were weighted?

I calculated weighted averages two ways: by the total numer of residents in a facility and by the number of stays reported in the PDPM provider specific data file.

| Technique | Average |

|---|---|

| Simple Average | 0.75% |

| Residents | 0.63% |

| 2017 Med A Stays | 0.49% |

This does seem to indicate that the larger facilities have lower rates of re-hospitalization increases. Is it a lot? Well that depends on how you look at it. The bottom line is still that the rate of increase is greater than zero and the financial incentive didn’t have the intended effect.

Maybe reducing re-hospitalization is simply a more difficult problem than can be fixed with financial penalties and incentives?